Why Waiting to Buy Property Might Cost You More: A Data-Driven Perspective

We've all heard the common concerns at social gatherings lately:

- "We can't afford to buy property right now."

- "We're waiting for property prices to come down."

- "High interest rates hold us back from buying property."

These sentiments are understandable, but recent data suggests that waiting might actually cost you more in the long run. Let’s dive into the numbers and explore why now might be the ideal time to make a move.

The Data Speaks Volumes

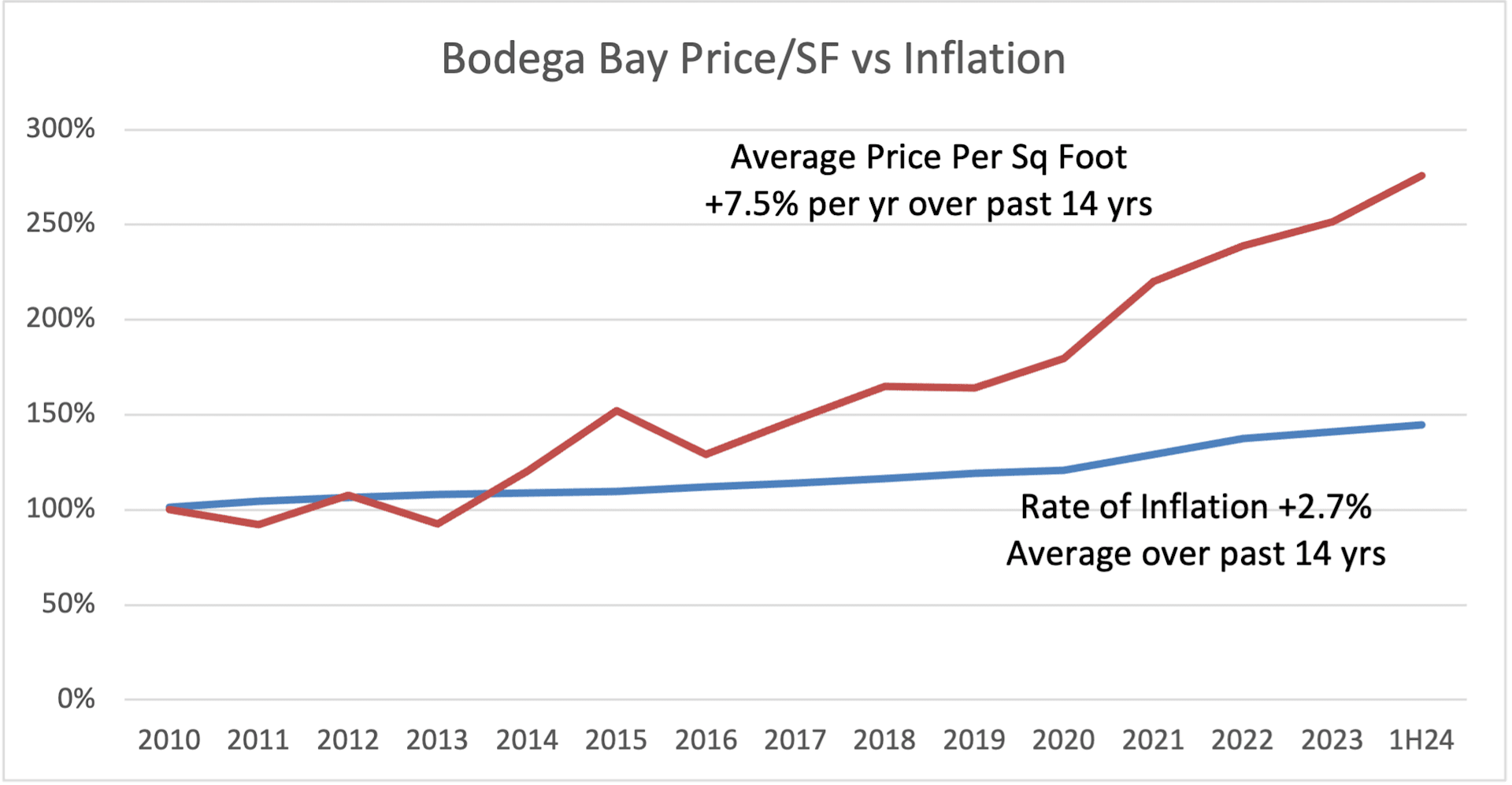

Our recent analysis of local market data reveals a compelling story. Since 2010, the average price per square foot—a crucial metric for comparing properties—has increased by an average of 7.5% per year. To put this into perspective, compare this with your 401(k) or other investments. It’s challenging to find consistent annual returns of 7.5% on investments over a long period. Additionally, the national rate of inflation has averaged 2.7% annually over the same 14-year period. This means local property appreciation is growing nearly three times faster than inflation.

Why Coastal Properties Are a Prime Investment

In areas like Bodega Bay and other coastal regions, the situation can be even more pronounced. Coastal properties are subject to stringent building restrictions, limiting the supply of new homes. Meanwhile, demand continues to rise. This combination of restricted supply and increasing demand creates a powerful environment for property value growth.

The Interest Rate Factor

It's true that high interest rates can be a deterrent for some buyers. However, it's important to remember that interest rates are not a permanent barrier. You have the option to refinance your mortgage when rates eventually decrease. Therefore, letting current interest rates hold you back could mean missing out on appreciating property values and the potential benefits of owning a home in a sought-after location.

Making an Informed Decision

When weighing your investment options, consider this: while interest rates may fluctuate in the short run, property values enjoy a clear upward trajectory. The potential for significant returns on property investment, especially in desirable areas like the coast, is substantial. If you’re waiting for the "perfect" moment, it might be wise to rethink your strategy.

By buying now, you can benefit from current property appreciation and possibly refinance at a lower interest rate in the future. Alternatively, your lender can discuss the benefits of an adjustable-rate mortgage with a plan to refinance to a fixed rate later when rates are more favorable. If you wait, you will likely face increased competition from other buyers, which could erode your potential appreciation. Delaying your purchase could mean missing out on valuable equity growth and potentially higher costs down the road.

In Conclusion

The real estate market is dynamic and influenced by various factors, but historical data and current trends suggest that waiting to buy property could be a costly decision. At Sonoma Coast Living, we believe that investing in property now can provide significant long-term benefits.

Thank you for tuning in to our blog. We look forward to sharing more insights and helping you navigate the real estate landscape.

Sincerely,

Thera Buttaro, Sonoma Coast Living

This blog post reflects our proprietary analysis and opinion, backed by data and market insights.